Mergers and Acquisitions

Introduction:

With over two decades of experience as both a barrister and a commercial litigator, I've not only facilitated successful M&A deals but have also witnessed first-hand the pitfalls and challenges that can arise when things don't go as planned.

This unique vantage point, combined with my expertise in corporate insolvency, equips me with a holistic understanding of the M&A landscape, ensuring that every deal is structured with foresight and precision.

Your Trusted Partner in M&A:

Navigating the intricate world of mergers and acquisitions requires more than just legal expertise; it demands a strategic mindset and a deep understanding of the commercial world.

Whether you're on the buy side or the sell side, I work directly with you from the outset, advising on everything from initial heads of terms to the final Share Purchase Agreement.

Experience That Counts:

Having seen the repercussions of deals gone awry in my years as a commercial litigator, I bring a unique perspective to the table. This experience, coupled with my knowledge of corporate insolvency, allows me to anticipate potential challenges and structure deals that stand the test of time.

I have represented on both the buy and sell side in small deals, £1 deals. to £10m plus deals.

I am told my real strength is explaining difficult concepts simply so that clients understand the underlying issues.

SPAs are effectively a way of allocating risk from the past into the future for both sides as well as ensuring both sides gets paid. It takes time and my approach is generally to spend as much time as required to go over things.

Creative Deal Structuring:

In the dynamic world of M&A, one size doesn't fit all. I pride myself on my ability to craft creative deal structures, including those with little or no money down.

Whether it's earn-outs, work-ins, delayed or deferred consideration, balloon payments or leveraged buyouts, I ensure that the deal structure aligns with your strategic objectives and financial considerations.

I am familiar with the approaches of people such as Jeremy Harbour, Jonathan Jay, Carl Allen, Roland Frasier and others. I was recently invited to speak to the Harbour Club, of which I am a member. I am an EPIC Board member.

Swift and Efficient Approach:

Time is of the essence in M&A deals.

My approach is swift, ensuring that deals maintain their momentum without compromising on due diligence or legal rigor.

I understand that lawyers can sometimes be deal breakers, but my ethos is to be a deal maker, working quickly on documents to keep the deal's momentum.

Transparent and Competitive Fee Structure:

I believe in transparency and value for my clients.

My competitive fee structure, which includes contingent and capped fees, ensures that you always know what to expect when it comes to costs.

At Simon Harding Law, Mergers and Acquisitions isn't just a service; it's a partnership.

With a deep understanding of the commercial world, a keen eye for detail, and a commitment to achieving the best outcomes, I'm here to guide you through every step of your M&A journey. Let's work together to make your next deal a success.

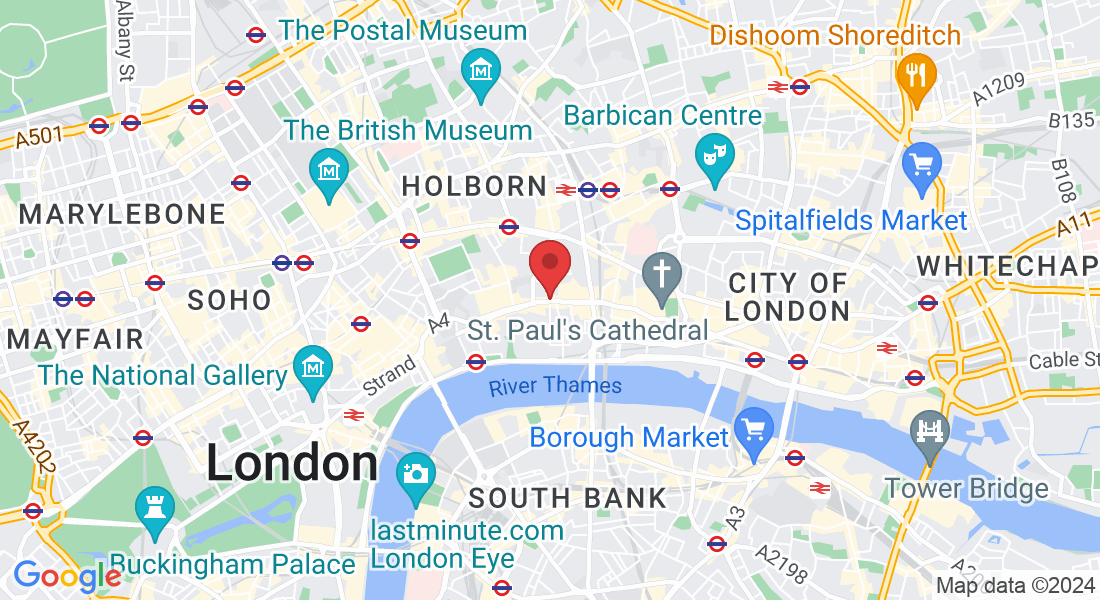

Office:

4-5 Gray's Inn Square, Gray's Inn, London WC1R 5AH

Call :

+44 7449 970015

Email:i

Privacy

www.simonhardinglaw.com/privacy